This article is an educational article only. It should not be considered financial advice.

I have done pretty much every investment mistake one could imagine.

I bought high, sold low, didn’t hold Tesla nor Bitcoin, gambled with rent money, and even sought financial advice from Twitter and WSB (Wallstreetbet).

If there is an investing mistake, you can be 200% certain I have made it.

While my direct losses probably amount to around €5 000 (I have since got this amount back thanks to the rules you are about to learn), my indirect losses (due to selling and not holding) amount to around €25k as these lines are written.

Ouch.

It’s ok.

In a way, I see this money as the price to pay to be educated.

I much prefer losing 30% of my net worth when my net worth is €7k than when it is (God forbid) €70 million.

The result of these losses was that I came up with 14 rules that now prevent me from making a bad investment decision.

These rules are full proof.

Follow them, and you will see your net worth growing.

Break them…and you’ll lose all of your money.

Table of Content

- No One Knows

- We Don’t Take Financial Advice from Reddit or Twitter

- We Don’t Buy at the Top

- We Buy at the Bottom

- We Don’t Sell at the Bottom, or to a Loss

- We Sell at the Top

- We Invest Into Non-Trendy Assets

- We Invest a Lot of Money in Wonderful Opportunities Instead of Spreading for “Risks”

- When We Buy, We Buy for 10 Years

- We Don’t Invest Rent Money

- We Believe In Extraordinary Buying Opportunities When They Present Themselves

- We Keep It Simple

- We Keep an Emergency Fund Worth 6 Months of Cost of Living That We Do Not Touch No Matter What Happens (Unless There Is an Emergency)

- We Keep Some Cash in Case There Is a Crash and Good Buying Opportunities Present Themselves

1. No One Knows

The first rule, when it comes to investing, is to understand that no one knows if it’s going to go up or down.

Nobody.

And the people that claim they know are:

- Full of sh*t

- Have interests in getting you to buy or sell

That being said, there are some ways to find out whether the asset has a future or not, which leads to the second rule.

2. We Don’t Take Financial Advice from Reddit or Twitter

I repeat.

Nobody knows.

People on Twitter and Reddit:

- Have interests in manipulating the market

- May not even be people

So, where should you take advice from when buying a stock?

I highly recommend watching this video where Bill Hackman, billionaire founder of hedge fund Pershing Square explains basic finance and investing.

Before purchasing a stock (or crypto), the only real question you should answer is: will this asset increase in value over time?

If the stock is a coal mine, it will likely not increase in value because the world is shifting towards renewable energy.

If the stock is a technology company making parts for self-driving cars, it will likely increase in value in the future.

However, the product itself isn’t the only metric to look at.

You should also look at whether the company is profitable, and who is running it (do they have a track record, are they smart, do they have a lot of equity in the company, etc).

This leads to the best of all of the rules, rule 3.

3. We Don’t Buy at the Top

We don’t buy at the top.

If there is one rule you need to respect, it’s this one, as it’s the one most likely to make you lose all of your money if you break it.

What does that mean?

It means that when markets show a fast increase in value, it is likely because buyers are speculating on the asset (buying and selling fast) instead of investing for the long term.

This means that the asset will eventually be overvalued. When it peaks, everyone will sell and it will crash.

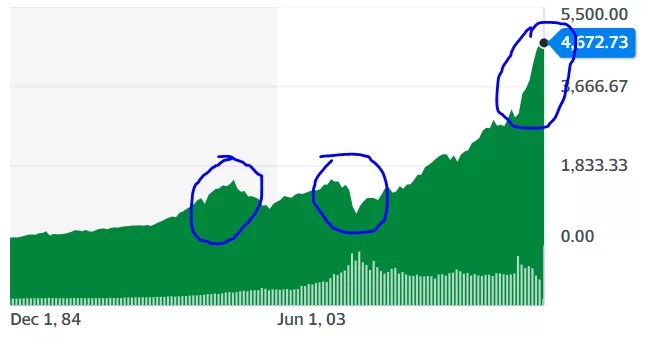

Let me take as an example, the Bitcoin value graph.

As you can see, there are three peaks.

How do the peaks look like?

Symmetrical.

When the value goes up fast, it goes down fast too.

When you buy an asset as it is going up, you expose yourself to a certain amount of risk as it has higher chances to go down.

And since you don’t know when it is going to go down, better be safe than sorry and wait that it pops.

This is basic technical analysis, and yet, few ever respect it.

Other examples of peaks.

This leads us to the fourth rule.

4. We Buy at the Bottom

Warren Buffett is a terrible investor.

He bought a bunch of companies on which he lost billions.

These losses were only offsets because he had made ONE GREAT investment that made him all of his money (insurance companies).

So, how did he become so rich?

Because he waited.

Buffett has always done the exact opposite of everyone else.

When the market is going well, he waits until it crashes.

Once the market crashes, he seizes the moment to buy stocks, knowing that after a crash, the stock market will eventually recover.

If you buy after a crash instead of buying when things are going well, you will drastically increase your chances to have your asset going up than down.

Another (risky) strategy I use is to google for stocks that are in a yearly or an all-time low.

I then pick companies I think have a future, buy a lot of their socks, wait, and when it rises, I sell.

Am I 100% certain that the asset won’t decrease?

No.

Do I maximize my chances to see the asset increasing?

Yes.

When it’s at an all-time low, you decrease the chances of the asset going even lower.

-> buy Bitcoin after Bitcoin crashes, not before!

5. We Don’t Sell at the Bottom, or to a Loss

Unless you picked a very bad asset (Safemoon), all assets eventually go up.

This is why you should never sell at the bottom, unless you have been holding for at least 10 years and the company will never be as powerful as it once was (Nokia).

6. We Sell at the Top

You are not obliged to respect this rule.

Consider the following tweet.

If the asset you bought makes money regularly through dividends (Eg: Apple) and has a great future, you might as well just hold it forever and enjoy the dividend.

This rule is practical when the asset is worthless and is only used for speculation (Bitcoin and 99% of cryptos).

The only problem is: how do you know when it reaches the top?

Well, you don’t.

So you can whether keep it forever, as Naval said, or you can establish a strategy.

1. You decide a certain percentage and when you reach it, you sell.

Eg: You want to earn 10% on Bitcoin. You buy BTC at 30k and sell at 33k.

You earned your 10%, thank you so much, goodbye.

2. You establish a number based on technical analysis.

You think the top of Bitcoin in the bull run will be, say, 65k. So you fix a 60k threshold to be sure, sell all of your BTC when it reaches 60k, and make a profit.

Too bad if it goes to 70k. The game is the game.

3. You sell little by little

Every time BTC increases by 10%, you sell 10% or 20% of your holdings. That enables you to be safe while maximizing your chances to catch the top.

4. You get back your capital once you reach 2X

Once you double your capital, you sell half of your shares so you can safely get back your original investment and gamble with the profits (great for crypto, not for stocks).

All of these methods can be mixed up.

7. We Invest Into Non-Trendy Assets

It has been shown time and again how the mainstream media push everyone to buy Bitcoin when it reaches 60k, and is announcing a 10-year bear market when it crashes down to 30k (only to get back to 60k 3 months later).

If you invest in an asset because you have heard about it in the mainstream media, it’s too late to invest.

Rather, make a list of all of the assets that exist, and invest in the ones the media aren’t talking about.

They are likely being undervalued.

Furthermore, search for new types of assets that aren’t mainstream yet (some people created an ETF with paintings, for example, or NFTs at the time) as it is likely these assets will increase in value very fast once they become mainstream.

8. We Invest a Lot of Money in Wonderful Opportunities Instead of Spreading for “Risks”

This one also comes from Warren Buffett.

Spreading your investment over several assets makes it less risky, but it also makes it perform less effectively.

What you want is to select one investment for which you know it is 99% going to increase by a lot, and just pour all of your money into it.

The idea is that you should never have more than 10 different assets, otherwise, you are spreading too much.

9. When We Buy, We Buy for 10 Years

I bought Tesla, Fiverr, Xiaomi, Bitcoin, Ethereum, and a bunch of other stocks and crypto and sold after a couple of months.

Had I waited, I would have done 10X on all of them and would be roughly €25k richer than I am now.

It hurts. But it’s life. And it’s also how you learn.

I always remind myself of Bitcoin when thinking about breaking this rule.

The people that sold it at 20k are not as rich as they could have been selling their BTC at 65k.

I once met a guy who had bought 1000 BTC for $100 and sold it for $1000 lmao.

Nobody knows how well (or badly) an asset will perform.

Wait.

You’ll make most of your money in the end.

10. We Don’t Invest Rent Money

Any money you invest is money you risk never seeing again.

Only invest money you wouldn’t mind losing.

Don’t invest money you use for rent, food, healthcare, or transport.

More than one have lost their life savings on WSB, and one guy even committed suicide.

11. We Believe In Extraordinary Buying Opportunities When They Present Themselves

I came up with this rule after I missed on opportunities and was rather satisfied to find out that Charlie Munger had the exact same one.

When you buy a stock, you are against everyone: the market, the person that sells it to you, the competitors of the company, etc.

A lot of people want you to fail, and few people want you to succeed.

I have seen some stocks like shell for $9 (instead of $30), or Tesla for less than $300, and did not believe in buying them because it was too good to be true.

“Who am I, I thought, to buy wonderful stock opportunities. These opportunities are for the pros, not for me.”

Oh, how wrong I was.

12. We Keep It Simple

Portfolio advisors hate themselves. In order to make their clients feel like they are needed, they have to complicate the investment which leads to worse performances than if the investment was simple.

A simple and great investment may just be to buy Google, Amazon, Apple, and Microsoft and hold.

“Duh”, you are going to tell me.

Most people don’t see it this way, but if these companies are the ones most likely to grow over the next 10 years, shouldn’t these be the ones to buy??

Of course yes.

This is why investing is so damn hard: it’s sometimes so simple that you can’t believe it!

Complicated investment ≠ high return investment!

Often, the best solutions are the simplest.

Just buy Amazon.

13. We Keep an Emergency Fund Worth 6 Months of Cost of Living That We Do Not Touch No Matter What Happens (Unless There Is an Emergency)

Don’t use your emergency fund for anything else but an emergency.

Yes, even if Bitcoin goes under 10k.

14. We Keep Some Cash in Case There Is a Crash and Good Buying Opportunities Present Themselves

This rule is tied to Warren Buffett’s investment advice.

At the end of the day, you win if you sell when everybody buys, and buy when everybody sells.

Buying when it’s low (after a crash) is the most efficient way to make money in the stock market. Or in any other market.

Final Word

This investment strategy borrows heavily from Warren Buffett (who borrowed heavily from Ben Graham).

The problem with this strategy is that it makes you take medium risks, for medium reward. Investing in individual stocks is quite dangerous. While Buffett and Munger both criticized the efficient portfolio theory as well as the idea of diversifying as much as you can to avoid risks, their own story shows that the critic is a tiny bit hypocritical.

80% of Buffett’s wealth is tied to seven stocks. Seven. He bought roughly 450 stocks in his 3-century career.

This story should make you go “hum…does Warren Buffett really know what he is doing?”

And the answer is no. He doesn’t know, because no one knows. But…there is a but. Warren’s strategy wasn’t as much about doing as it was about not doing.

Warren avoided all of the traps most investors eventually fall into – mostly greed. His success comes more from avoiding risky investments and not losing money than it comes from earning money. If you buy the S&P 500 and wait for 50 years, you’ll be rich.

The only problem is that you’ll be old.

So I want to introduce another strategy, stolen directly from one of my favorite thinkers, Nassim Taleb (yes, him again).

Taleb practices the Barbell Strategy. The Barbell Strategy is about being extremely conservative on one end to limit the downside and extremely risky on the other to maximize the upside.

Concretely, it translates to investing 90% of your money into treasury bonds, the safest asset there is, and investing 10% in risky startups or coins that could do 100X in a couple of weeks.

If you lose, you only lose 10%. If you win, you can win really, really big.

Photo by Todd Quackenbush on Unsplash

For more articles, head to auresnotes.com.